Accounting Software For Mac Home One Time Purchase

Chrome console macro. Jan 3, 2019 - Are you looking for accounting software like Quickbooks for Mac that will. You can purchase QuickBooks for Mac for a one-time fee of $299.99. Get the Office Home & Business 2019 at Microsoft Store and compare products. One-time purchase for 1 PC or Mac • Classic 2019 versions of Word, Excel,.

Kathy Yakal The Best Small Business Accounting Software for 2019 If you're running a small business, keeping a tight grip on finances is critical for success. Our reviews cover the best online accounting apps and services to help keep your company in the black. Keep Your Business Running With an Online Accounting Service According the US Bureau of Labor Statistics, about 20 percent of small businesses fail before they complete their second year. Among the many potential culprits for this widespread demise is the lack of effective money management and bookkeeping. Small business accounting software can do a lot to prevent your business from falling into this trap, keeping you on the right side of that grim statistic. Financial bookkeeping is complicated and time-consuming. Business owners find it challenging enough to cover the basics—paying the bills and tracking incoming revenue—let alone answer critical questions such as these: Are we profitable?

Why or why not? Can we make required tax payments? Should we invest in new equipment? Do we need to explore financing? Will we hit our budget numbers?

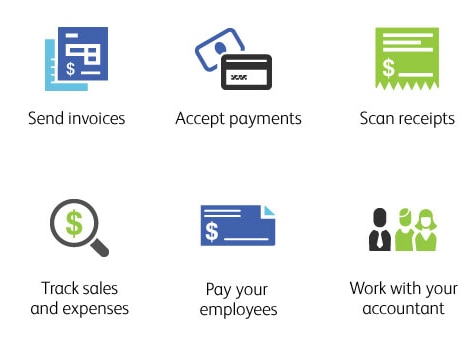

Where can we cut? A good small business accounting website can answer these questions in seconds, based on the input you provide. Once you've populated a site with information about your financial accounts, your customers and vendors, and the products or services you sell, you'll be able to use that data to create transactions.

These feed into reports, which can provide critical insight. Instant search tools and customizable reports help you track down the smallest details and see overviews of how your business is performing. And for the services give you access to your finances anywhere that you have wireless connectivity. QuickBooks Online's advanced implementation of technology, its skillful blend of features, its customizability, excellent mobile apps, and user experience have made it our Editors' Choice again this year. We're not crazy about the recent price increase, but Intuit services are often heavily discounted. Setting Up Bookkeeping Depending on how long your business has been operating, getting started with an accounting website can take anywhere from five minutes to several hours after signing up for an account.

Accounting services charge monthly subscription fees and usually offer free trial periods. The more you need the site to do, the longer your setup tasks will take (and the higher the monthly payment).

First, you'll need to supply your contact details. If you want your logo to appear on sales and purchase forms, you can upload a file containing it. Some accounting service sites ask whether you plan to use specific features like purchase orders and inventory tracking, so they can turn them on or off. You may also be asked when your fiscal year starts, for example, and whether you use account numbers.

Do you want access to the transactions you have stored in online financial accounts (checking, credit cards, and so on)? Enter the user name and password you use to log on, and the accounting site will import recent transactions (usually 90 days' worth) and add them to an online register. Would you like to let customers pay with credit cards and bank withdrawals? Do i really need to create a bootable installer for high sierra mac. You'll need to sign up with a payment processor like Stripe or (extra charges will apply). Your People and Your Stuff One of the really great things about using an accounting website is that it reduces repetitive data entry.

Once you fill in the blanks to create a customer record, for example, you'll never have to look up that ZIP code again. When you need to use a customer in a transaction, it'll appear in a list. The same goes for vendors, items or services, and employees. No more card files or messy spreadsheets. Once you've completed a customer record and started creating invoices, sending statements, and recording billable expenses, all of those actions will appear in a history within the record itself. Some sites, like Zoho Books, display a map of the individual or company's location and let you create your own fields so you can track additional information that's important to you (customer since, birthday, and other things like that).

If you have employees that you've been paying using another method, payroll setup can take some time and effort, since you'll have to enter payroll history information. Even when you're starting fresh with employee compensation, there's a lot of ground to cover. The site needs very precise details about things like your payroll tax requirements, provided, and pay cycles.