Free Checking Software For Mac

Jan 2, 2019 - I would learn about Intuit's Quicken software but it felt silly to pay for software. Today, you have free personal finance apps that are better than what. Tiller is a service that will connect with your bank and credits card to pull.

I spent a significant amount of time on this one myself. Vnc viewer for mac says system idle. Short answer, it's not possible to change the default listening port of the built in VNC server on OSX Lion (except by possibly modifying the /private/etc/services file to change the rfb service to listen to something other than 5900 for TCP/UDP).

Managing your money isn’t easy, so it’s no wonder that only 41% of Americans have a budget,. A budget is the most fundamental financial planning tool out there, and with one, you’ll have a better chance of reaching your short- and long-term financial goals. And if the “b word” makes you bristle, don’t worry: The best personal finance software can make it surprisingly painless.

“Online banking is a great tool to pay bills and reduce paper statements,” says Dan Crimmins, New Jersey-based financial coach at. “However, it cannot establish a budget or categorize your expenses. A financial tracking software gives you the ability to review how you are spending your money.” Several personal finance apps and websites can help you plan and keep track of your spending. No one service is best for everyone, though, so it’s important to compare several options to find the one that works best for you. To help, we’ve put together a list of the top three personal finance software options and how they can help you achieve your goals. Best Personal Finance Software: The Simple Dollar’s Top Picks • Mint: Comprehensive, free, and easy-to-navigate software; great for beginners. • You Need a Budget: Hardcore budgeting for people who want to know where every dollar is going.

• Albert: Does a lot of the legwork for you and provides you with timely and actionable advice. Mint has more than, and it’s easy to see why. For starters, the software is free to use, and it automatically syncs your financial accounts so you can budget and track your spending all in one place.

Budgeting isn’t the only service Mint offers, though. You can also: • Monitor your Equifax credit score. • Stay on top of your bills. • Track your investment accounts. • Get alerts when you’re being charged fees or going over budget.

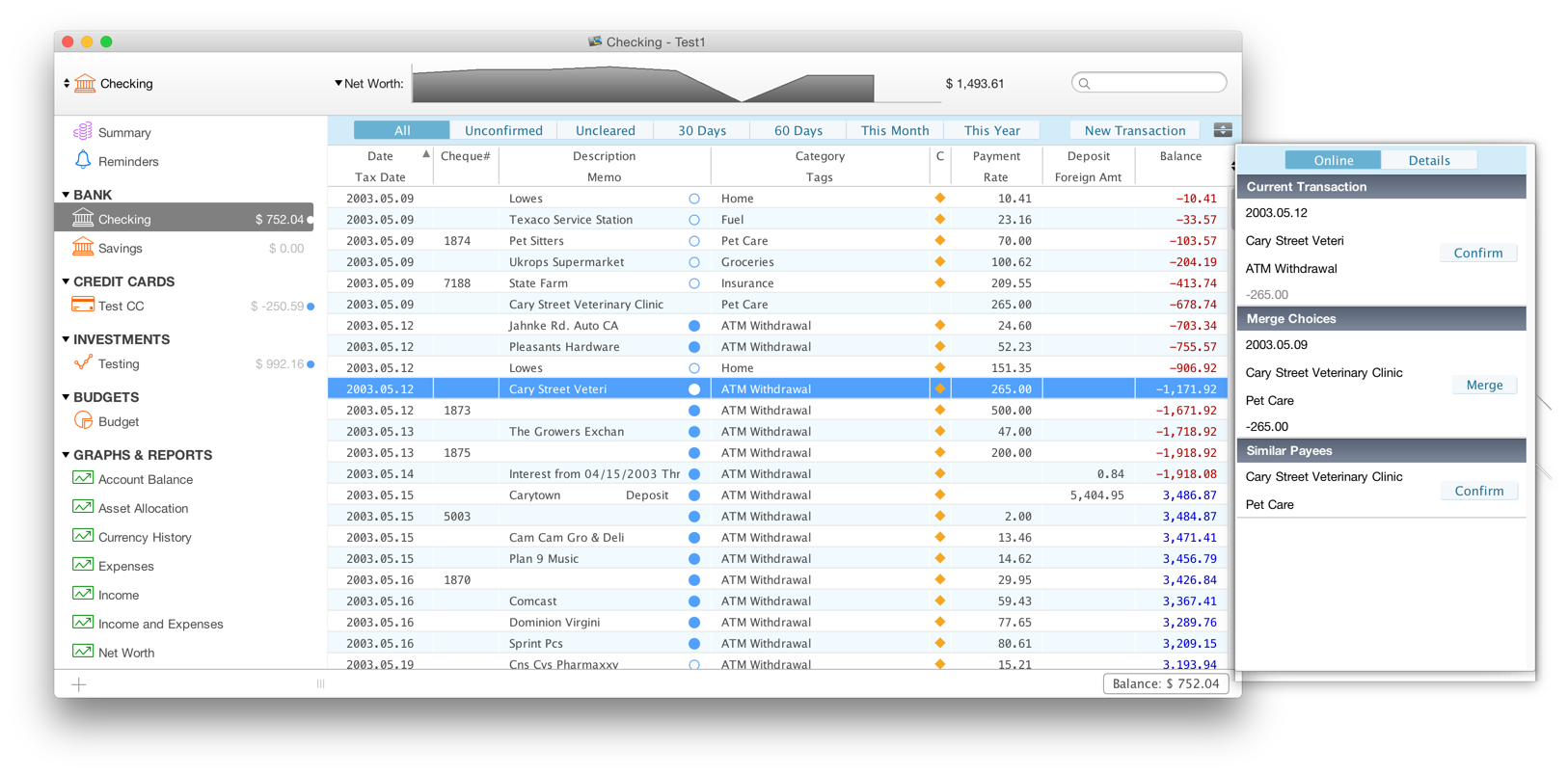

• View your home’s value (courtesy of Zillow) and track your overall net worth. For budgeters, Mint’s most valuable feature is its automatic syncing. Just sign into your bank and credit card accounts through Mint’s platform, and you’ll get updates on each account every time you make a transaction. When transactions come through, Mint will automatically categorize them based on their details. If the assigned category is wrong, you can update it and even split transactions into more than one category online or on the mobile app. Based on your spending, Mint will also create a budget for you.

But as with the transactions, you can customize your budget based on your needs and spending habits. If you want a bird’s eye view of your spending habits, Mint has a Trends feature that shows you how you’ve spent your money by category over a set period. You can also compare two periods to see how your current spending compares with spending in the past. While the service is free to use, Mint makes its money by recommending targeted financial products to its users.

Depending on your tolerance for such ads, it can be frustrating to feel bombarded with the unsolicited advice. “Most free financial softwares make money by providing product recommendations or having advertisements within the software or app,” says Dominique Broadway, CEO and personal finance expert at. Mint is a great option for: • Beginners who are overwhelmed with the idea of budgeting. • Hands-off budgeters who want everything in one place. • People who don’t mind the ads. You Need a Budget, or YNAB for short, is an intensive budgeting software with the goal of giving every dollar a job.

The software is also designed to help users and live off of the previous month’s income. When you first sign up, YNAB provides you with some general budgeting categories to start with, like Rent/Mortgage, Electric, Groceries, and other essential expenses. You can add or change categories based on your spending habits. As you continue setting up your budget — either online or with the mobile app — you can add individual accounts and clarify whether each is a budget account or just an account you’re tracking, such as an investment account or auto loan. While YNAB allows you to connect your financial accounts for automatic transaction importing, it doesn’t require it, allowing you to choose how hands-on you want to be.